Explain Fixed Cost And Variable Cost With The Help Of Diagram . Taken together, fixed and variable costs are the total cost of keeping your business. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Fixed costs and variable costs. Businesses incur two types of costs: fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance,. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. Fixed costs remain the same throughout a specific period. Examples of fixed costs include rent, taxes, and insurance. fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Variable costs can increase or decrease based on the output of the business. Variable costs change in relation to a company’s production output and/or sales volume.

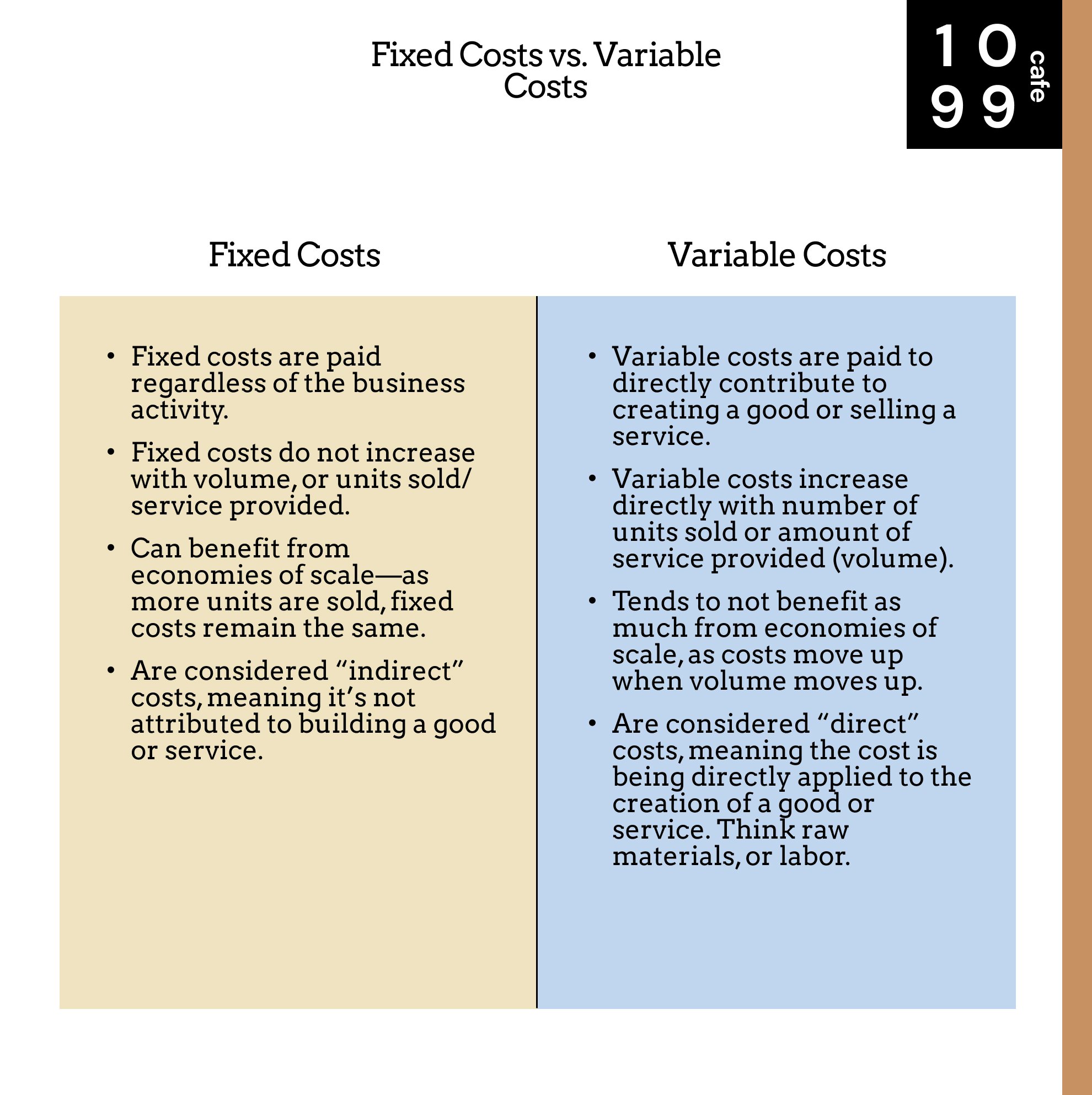

from www.1099cafe.com

Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Variable costs can increase or decrease based on the output of the business. fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance,. Fixed costs remain the same throughout a specific period. Businesses incur two types of costs: Variable costs change in relation to a company’s production output and/or sales volume. Fixed costs and variable costs. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Examples of fixed costs include rent, taxes, and insurance.

What is a Fixed Cost Variable vs Fixed Expenses — 1099 Cafe

Explain Fixed Cost And Variable Cost With The Help Of Diagram fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. Fixed costs and variable costs. Variable costs can increase or decrease based on the output of the business. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance,. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Examples of fixed costs include rent, taxes, and insurance. Variable costs change in relation to a company’s production output and/or sales volume. Fixed costs remain the same throughout a specific period. Taken together, fixed and variable costs are the total cost of keeping your business. Businesses incur two types of costs: fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements.

From www.economicshelp.org

Diagrams of Cost Curves Economics Help Explain Fixed Cost And Variable Cost With The Help Of Diagram Variable costs can increase or decrease based on the output of the business. Examples of fixed costs include rent, taxes, and insurance. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Fixed costs. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.economicshelp.org

Diagrams of Cost Curves Economics Help Explain Fixed Cost And Variable Cost With The Help Of Diagram Fixed costs and variable costs. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance,. Variable costs can increase or decrease based on the output of the business. Variable. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.youtube.com

Differences between Fixed Cost and Variable Cost. YouTube Explain Fixed Cost And Variable Cost With The Help Of Diagram Businesses incur two types of costs: Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Taken together, fixed and variable costs are the total cost of keeping your business. fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Variable. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.educba.com

Fixed Cost Vs Variable Cost Top 12 Key Differences & Examples Explain Fixed Cost And Variable Cost With The Help Of Diagram Taken together, fixed and variable costs are the total cost of keeping your business. fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. A fixed cost remains the same regardless of a business’s. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.founderjar.com

Variable Cost vs. Fixed Cost What's the One Key Difference? FounderJar Explain Fixed Cost And Variable Cost With The Help Of Diagram Businesses incur two types of costs: Taken together, fixed and variable costs are the total cost of keeping your business. Variable costs can increase or decrease based on the output of the business. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. fixed costs remain constant regardless of production. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From tutorstips.com

Difference between Fixed Cost and Variable Cost Tutor's Tips Explain Fixed Cost And Variable Cost With The Help Of Diagram Variable costs can increase or decrease based on the output of the business. fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. Fixed costs remain the same throughout a specific period. fixed costs are expenses. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From cedbveeo.blob.core.windows.net

Fixed Cost And Variable Cost Examples For Manufacturing at Judy Smith blog Explain Fixed Cost And Variable Cost With The Help Of Diagram Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Taken together, fixed and variable costs are the total cost of keeping your business. Fixed costs and variable costs. Examples of fixed costs include rent, taxes, and insurance. A fixed cost remains the same regardless of a business’s sales volume, production. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From dakotakruwli.blogspot.com

Explain the Difference Between Fixed Costs and Variable Costs Explain Fixed Cost And Variable Cost With The Help Of Diagram Fixed costs remain the same throughout a specific period. Taken together, fixed and variable costs are the total cost of keeping your business. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Businesses incur two types of costs: fixed costs remain constant regardless of production volume, while variable costs. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From byjus.com

Draw total variable cost, total cost and total fixed cost curves in a Explain Fixed Cost And Variable Cost With The Help Of Diagram Taken together, fixed and variable costs are the total cost of keeping your business. Businesses incur two types of costs: Fixed costs remain the same throughout a specific period. Variable costs can increase or decrease based on the output of the business. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.educba.com

Fixed Cost Vs Variable Cost Top 12 Key Differences & Examples Explain Fixed Cost And Variable Cost With The Help Of Diagram Variable costs can increase or decrease based on the output of the business. fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance,. Fixed costs remain the same throughout a specific period. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.cheggindia.com

Fixed Cost and Variable Cost Comprehensive Guide for 2024 Explain Fixed Cost And Variable Cost With The Help Of Diagram Variable costs can increase or decrease based on the output of the business. Fixed costs remain the same throughout a specific period. fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Examples of fixed costs include rent, taxes, and insurance. fixed costs remain constant regardless of production volume,. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From accountingdrive.com

Fixed vs. Variable Costs Everything You Need to Know Accounting Drive Explain Fixed Cost And Variable Cost With The Help Of Diagram Fixed costs remain the same throughout a specific period. fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. Variable costs change in relation to a company’s production output and/or sales volume. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. Businesses incur two types of. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.difference.wiki

Fixed Cost vs. Variable Cost What’s the Difference? Explain Fixed Cost And Variable Cost With The Help Of Diagram Variable costs can increase or decrease based on the output of the business. fixed costs are expenses that remain the same no matter how much a company produces, such as rent, property tax, insurance,. Fixed costs remain the same throughout a specific period. fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels.. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From efinancemanagement.com

Fixed Cost What It Is And What's Its Importance? Explain Fixed Cost And Variable Cost With The Help Of Diagram A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. Fixed costs and variable costs. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Taken together, fixed and variable costs are the total cost of keeping your business. Fixed costs remain the same. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.collidu.com

Fixed and Variable Cost PowerPoint Presentation Slides PPT Template Explain Fixed Cost And Variable Cost With The Help Of Diagram fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Taken together, fixed and variable costs are the total cost of keeping your business. Fixed costs remain the same throughout a specific period. fixed. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.numerade.com

SOLVED 'Explain the difference between fixed cost and the variable Explain Fixed Cost And Variable Cost With The Help Of Diagram Fixed costs remain the same throughout a specific period. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Variable costs can increase or decrease based on the output of the business. Fixed costs and variable costs. Examples of fixed costs include rent, taxes, and insurance. Businesses incur two types of. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From www.youtube.com

Fixed cost and Variable cost with all Diagrams Class 11 Micro Explain Fixed Cost And Variable Cost With The Help Of Diagram Businesses incur two types of costs: fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. A fixed cost remains the same regardless of a business’s sales volume, production output, or total revenue. Variable costs can increase or decrease based on the output of the business. fixed costs are expenses that remain the. Explain Fixed Cost And Variable Cost With The Help Of Diagram.

From brainly.in

Illustrate the relation between marginal cost average total cost Explain Fixed Cost And Variable Cost With The Help Of Diagram fixed and variable costs are key terms in managerial accounting, used in various forms of analysis of financial statements. Fixed and variable costs are the two ways to categorize business expenses that almost all businesses need to pay. Examples of fixed costs include rent, taxes, and insurance. fixed costs remain constant regardless of production volume, while variable costs. Explain Fixed Cost And Variable Cost With The Help Of Diagram.